Finance Virtual Assistant

In the modern era of remote work and digital transformation, the role of finance staff virtual assistant has become increasingly significant. These skilled professionals provide invaluable support to finance departments, assisting in various critical tasks that drive financial stability and success for businesses. This page explores the dynamic world of finance staff virtual assistants, their key responsibilities, and the numerous benefits they bring to organizations. From financial analysis and bookkeeping to data management and reporting, they play a crucial role in optimizing financial operations and ensuring the smooth functioning of businesses. Let’s go through an in-depth understanding of finance staff virtual assistants, exploring their roles, key responsibilities, benefits, and the ways in which they can enhance financial operations in organizations.

The Role of Finance Staff Virtual Assistants

Finance staff virtual assistants are highly trained professionals who work remotely to support the finance department of organizations. They possess a diverse skill set and expertise in financial management, enabling them to handle a range of crucial responsibilities. From assisting with financial analysis and forecasting to managing accounts payable and receivable, finance staff virtual assistants provide essential support in maintaining financial discipline and accuracy.

These professionals are adept at conducting financial research, analyzing financial statements, preparing reports, and assisting in strategic financial planning. They also play a crucial role in monitoring financial performance, identifying cost-saving opportunities, and ensuring compliance with financial regulations and internal policies.

Expertise and Qualifications

Finance VAs possess a strong background in finance and accounting, often holding degrees in finance, accounting, or a related field. They have comprehensive knowledge of financial principles, practices, and regulations. Additionally, these professionals are proficient in using financial software, such as QuickBooks, Excel, and financial analytics tools, to perform complex financial calculations and generate accurate reports. Strong analytical skills, attention to detail, and the ability to interpret financial data are essential qualities that finance staff virtual assistants bring to the table. Their expertise combined with their adaptability to new technologies ensures they can effectively handle a wide range of financial tasks.

Financial Analysis and Reporting

One of the primary responsibilities of finance VA is to assist in financial analysis and reporting. They collaborate with finance teams to gather and analyze financial data, identify trends, and generate reports that provide valuable insights for decision-making. These reports include financial statements, cash flow analysis, and performance metrics, which help businesses evaluate profitability, identify areas for improvement, and make informed strategic decisions.

Bookkeeping and Data Management

Finance VAs are proficient in bookkeeping and data management tasks. They handle the organization and maintenance of financial records, ensuring accurate and up-to-date information for financial reporting purposes. These virtual assistants are skilled in managing accounts payable and receivable, tracking expenses, reconciling bank statements, and maintaining general ledgers. Their expertise in utilizing accounting software and technology streamlines data management processes, improving efficiency and reducing the likelihood of errors.

Financial Systems and Technology

As technology continues to advance, they remain at the forefront of leveraging financial systems and tools. They are proficient in utilizing financial software, enterprise resource planning (ERP) systems, and data analysis tools to streamline financial operations and improve efficiency. Their familiarity with technology-driven financial solutions allows businesses to stay competitive and adapt to changing market demands.

Budgeting and Forecasting

Finance VAs actively participate in the budgeting and forecasting process. They assist in developing budgets, analyzing historical financial data, and generating accurate forecasts for future financial planning. With their support, organizations can establish realistic financial goals, allocate resources effectively, and monitor budget performance throughout the year. This proactive approach to budgeting and forecasting enables businesses to make informed decisions, adapt to changing market conditions, and optimize financial resources.

Enhancing Financial Operations

Finance VAs play a crucial role in enhancing financial operations within organizations. Their expertise in financial analysis and reporting ensures accurate and insightful information for decision-making. They assist in preparing financial reports, conducting variance analysis, and identifying key performance indicators to track financial performance and guide strategic decision-making. Additionally, virtual assistants contribute to budgeting and forecasting processes, helping organizations allocate resources effectively and set realistic financial goals. They also provide valuable support in risk management, identifying potential risks, implementing control measures, and monitoring compliance with regulations. By ensuring financial compliance and governance, virtual assistants mitigate risks and enhance the organization’s overall financial stability.

Financial Compliance and Auditing

Finance staff virtual assistants contribute to ensuring financial compliance and preparing for audits. They possess knowledge of financial regulations, accounting principles, and reporting standards, allowing them to assist in maintaining compliance with legal requirements. These virtual assistants work closely with auditors during external audits, providing necessary documentation, reconciling financial records, and assisting in the resolution of audit findings. Their expertise in compliance and auditing processes helps organizations meet regulatory obligations and maintain financial transparency.

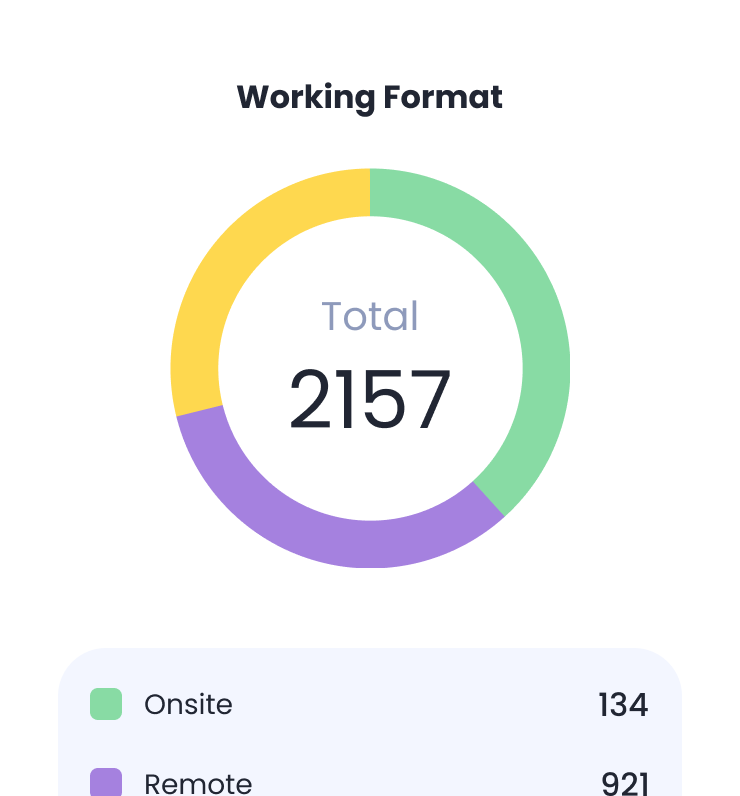

Benefits of Finance Virtual Assistant

The utilization of finance VAs offers numerous benefits to organizations. Firstly, it provides cost savings as virtual assistants are often hired on an hourly or project basis, eliminating the need for full-time employees. Secondly, these virtual assistants offer flexibility and scalability, allowing organizations to scale their finance team based on their needs. They can seamlessly handle workload fluctuations and provide support during peak periods. Additionally, virtual assistants bring specialized expertise, enabling organizations to tap into a wide range of skills without the need for extensive training or recruitment efforts. Moreover, virtual assistants offer businesses the opportunity to access talent from different geographic locations, allowing for diverse perspectives and global reach.

Financial virtual assistants play a pivotal role in supporting the finance department of organizations, contributing to financial stability, accuracy, and success. With their expertise in financial analysis, bookkeeping, budgeting, and compliance, they bring value by providing crucial support and ensuring the smooth functioning of financial operations. By leveraging their skills in financial analysis, budgeting, risk management, and compliance, businesses can optimize their financial processes, drive growth, and achieve long-term success. As technology continues to advance and remote work becomes more prevalent, their role will only continue to grow, reshaping the future of finance operations and delivering greater value to organizations. The capabilities of finance virtual assistants allow businesses to optimize their financial management processes, reduce costs, and enhance decision-making. By embracing this innovative virtual staffing solution, organizations can unlock the power of finance staff virtual assistants and achieve greater efficiency, productivity, and long-term financial success.

Talk To Us

You can book a call and we’ll explain the whole process. We are based in Australia with all our staff based in the Philippines and have clients across the globe.